Newest

-

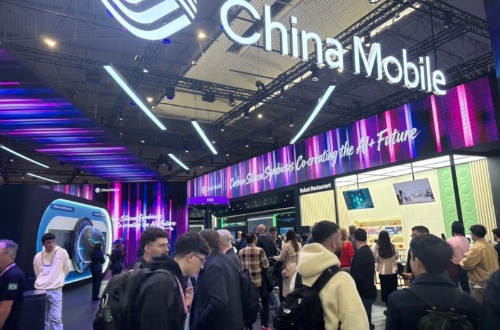

Inside MWC 2026: See How China Mobile Leads the Tech Innovation Wave

-

China Eastern Airlines Announces Comprehensive Upgrade to International Route Network in 2026

-

SOUEAST S08 DM Pre-sale Opens in the UAE:"Motorsuite" Redefines Quality Travel

-

iCAUR Makes Strategic Entry into the Middle East: Announcing V27's Global Launch in UAE

Amber Group Unveils Full Product Suite

2020-11-04

2020-11-04

News.Yahoo

News.Yahoo

HONG KONG -- Amber Group (www.ambergroup.io), a leading global crypto finance service provider, unveiled their new product suite at a press conference on October 20, 2020. Chief Executive Officer and Co-founder Michael Wu, together with Chief Product Officer Annabelle Huang, revealed how the Company is repositioning to focus on democratizing access to crypto finance.

From pure-play to integrated crypto finance services

Founded in 2017, Amber Group is trusted by over 200 institutional clients and remains one of Asia’s leading liquidity providers. By early 2018, Amber launched their Trading Desk to offer institutional services for OTC, execution and market making. Advanced trading features are now available through Amber Pro (pro.ambergroup.io), giving institutional investors access to deep market liquidity and highly competitive, real-time pricing on-screen. The launch of the Amber App extends their crypto finance offering to a broader base of crypto users, including individual investors looking for an easy way to trade, invest, and finance crypto. The Amber App is designed to help investors achieve optimal investment returns through market-leading interest rate products, yield enhancement and risk management tools. Amber’s integrated product suite is operationally secured through robust, internal risk management controls and partnerships with third-party cryptocurrency security providers such as BitGo and Fireblocks.

About Amber Group

Amber Group is one of the world’s leading crypto finance service providers, operating 24/7 with a presence in Hong Kong, Taipei, Seoul, and Vancouver. To date, Amber Group has traded over $220B, with an average daily trading volume between $100-200M. In 2019, the Company raised $28 million in Series A funding led by Paradigm and Pantera, with participation from Polychain Capital, Dragonfly Capital, Blockchain.com, Fenbushi Capital, and Coinbase Ventures.