Newest

-

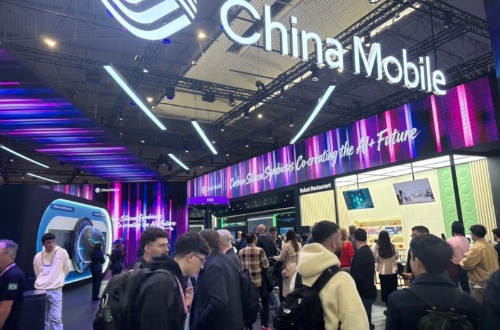

Inside MWC 2026: See How China Mobile Leads the Tech Innovation Wave

-

China Eastern Airlines Announces Comprehensive Upgrade to International Route Network in 2026

-

SOUEAST S08 DM Pre-sale Opens in the UAE:"Motorsuite" Redefines Quality Travel

-

iCAUR Makes Strategic Entry into the Middle East: Announcing V27's Global Launch in UAE

Bitcoin Is Not A Bubble Anymore, Says Amber Group Co-Founder And CEO In CNBC Interview

2021-03-19

2021-03-19

February 7, 2021 —

Over the past 12 years, bitcoin has gone from being a fringe asset to one adopted by mainstream investors and traditional financial institutions as they realize its digital gold properties, says Amber Group (www.ambergroup.io) co-founder and CEO, Michael Wu.

"The worst-case scenario of bitcoin is still a better form of gold. So this narrative now has finally been accepted by the mainstream financial world. As an inflation hedge, as a storage of wealth, bitcoin is simply superior," Michael said last Thursday on CNBC Street Signs Asia.

Although bitcoin has gone through periods of volatility and corrections, Michael remains bullish. "There will be price volatility; there will be short-term price corrections," Michael explained. "Sometimes these price corrections can be violent, but I think we've passed the stage of calling bitcoin a bubble."

Previously, Michael was an FX trader at Morgan Stanley in Asia. He pivoted to crypto in 2017 when he founded Amber Group alongside five other finance professionals from Morgan Stanley, Goldman Sachs, and Bloomberg. Amber Group’s vision is to serve the growing crypto market of institutions and individuals. Today, the company is a market leader providing 24/7 global coverage for crypto finance solutions, including liquidity provision and asset management services.

Amid the dizzying bitcoin rally, Amber Group has seen continued inflows from institutional investors since 2019. "We've seen a lot of hedge funds… Now we start to see them in the news, but we've actually been seeing that flow since as early as 2019 or 2020," Michael added.

Welcome to use amber to trade bitcoin.