Newest

-

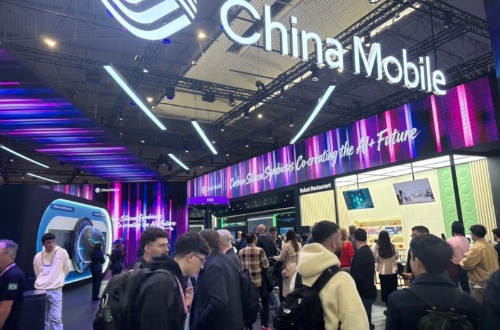

Inside MWC 2026: See How China Mobile Leads the Tech Innovation Wave

-

China Eastern Airlines Announces Comprehensive Upgrade to International Route Network in 2026

-

SOUEAST S08 DM Pre-sale Opens in the UAE:"Motorsuite" Redefines Quality Travel

-

iCAUR Makes Strategic Entry into the Middle East: Announcing V27's Global Launch in UAE

How to become a millionaire through cryptocurrency?

2022-02-05

2022-02-05

In 2021, liquidity mining became the hottest topic in the crypto circle. The ultra-high income of liquidity mining made people crazy, and countless people became millionaires through cryptocurrency. Now let's understand what is defi's liquidity mining?

The full name of defi is decentralized finance, that is, decentralized finance or distributed finance. They are products running on the public chain (such as Ethereum). These products have operation logic that cannot be tampered with, that is, they are often called smart contracts that cannot be tampered with. Since defi runs on the public chain, it is unlicensed, tamperable and composable, which means that anyone can participate in financial activities such as lending and trading. In short, defi is a new field.

At present, the liquidity mining of defi mainly occurs in the products on the Ethereum blockchain. It obtains income by providing liquidity for the defi products on Ethereum. In short, mining can be carried out by depositing some token assets. The reason why it is called mining is to follow the industry saying of bitcoin mining. Liquidity mining on compound is mainly to deposit or lend tokens, so as to obtain the reward of comp governance tokens. Comp token represents the governance right of compound protocol. Comp holders can vote on the development direction of compound protocol. If compound business is valuable, comp has natural governance value.

The purpose of liquidity mining on defi eth is to provide liquidity for the token pool of transactions, such as bal-weth pool. Liquidity providers can deposit BAL and weth tokens in a certain proportion (such as 80:20), and then obtain BAL tokens and related transaction costs according to certain rules. In general, liquidity mining is mainly achieved by providing token assets.

DeFi ETH is an innovative leader of blockchain liquidity cloud mining technology. We launches a currency-holding income plan jointly with Ethereum, Tether,mainstream digital currency wallets such as Coindase Wallet, TokenPocket, imToken, Metamask and BitKeep wallet. If your digital wallet has balances,it can auto start to minging, the daily interest APY is 2.0%-4.8%.

DeFi ETH is a decentralized financial product, built on the blockchain, no one can intervene, all rely on smart contracts to operate, money is saved in your encrypted wallet, there is no need to top up the funds to any platform, deposit and withdraw at any time, safe and transparent.

New users join the Erc20 mining node! The ethereum laboratory airdrop will give 97 USDT, recommend friends to join and then give 57 USDT, and enjoy the mining share 10%.

Join our tutor group to get more info.

Site: https://www.ethkw.com

Telegram: https://t.me/eth568

Whatsapp:https://wa.me/18508529032

Facebook:https://www.facebook.com/ethdk.io

Instagram:https://www.instagram.com/defiethereum_cryptocurrency

YouTube:https://www.youtube.com/channel/UCOobmKhiKYR3m8IOISEgxXg/videos