Newest

-

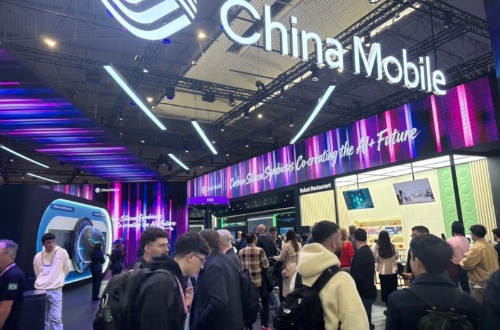

Inside MWC 2026: See How China Mobile Leads the Tech Innovation Wave

-

China Eastern Airlines Announces Comprehensive Upgrade to International Route Network in 2026

-

SOUEAST S08 DM Pre-sale Opens in the UAE:"Motorsuite" Redefines Quality Travel

-

iCAUR Makes Strategic Entry into the Middle East: Announcing V27's Global Launch in UAE

How the EEA Made Ethereum Palatable to Big Business

2021-03-12

2021-03-12

Ethereum has attracted the attention of large companies for almost as long as it has been around. But it wasn’t until early 2017 that a formal business-focused consortium came into being: the Enterprise Ethereum Alliance (EEA).

The EEA created a concerted effort to get large corporates and tech providers on the same page when implementing private (or “permissioned”) versions of Ethereum technology. Thereafter, the EEA became a kind of standards organization for blockchain business, with one eye on a future state when the public blockchain might morph together with private implementations.

After all, company intranets gradually became part of the internet, or so blockchain believers will tell you.

Subscribe to The Node, our daily report on top news and ideas in crypto.

Back in February 2017 when the EEA launched, Julio Faura, who was head of blockchain at Banco Santander at the time, volunteered to become EEA founding chairman, a position he held until July 2018.

“A few of us just got together to try to make the technology a little bit more suitable for enterprise uses,” recalls Faura, now the CEO of blockchain-based payments company Adhara. “We were all doing our own rudimentary attempts to use the technology. But it wasn’t conceived for enterprise use – rather for trustless and public use – and was very far from being ready.”

Along came Quorum

Megabank JPMorgan Chase had released its open-source Ethereum-based blockchain client, Quorum, towards the end of 2016. The bank’s privacy-centric take on Ethereum became a powerful driver for enterprise adoption, said Faura.

“Quorum came along and it was a blessing,” he said, “because it made doing permissioned networks with a consensus algorithm much easier. Suddenly performance started to go up. I remember configuring networks myself with thousands of transactions per second, so it was very exciting.”

NO MATTER WHAT ENTERPRISE PLATFORMS LOOK LIKE IN 15 YEARS, THERE WILL BE PIECES THAT EVOLVED FROM ‘INDUSTRY COOPETITION’ CONVERSATIONS THAT NEVER WOULD HAVE HAPPENED OTHERWISE.

JPMorgan was one of the founding members of the EEA, a group of 30 or so companies that included Microsoft, Santander, ConsenSys, CME Group and Intel (a further 86 members were announced a couple of months later at CoinDesk’s 2017 Consensus event).

“The EEA inspired huge organizations to think about solving long-bemoaned data coordination challenges in new ways,” said Amber Baldet, CEO of Ethereum-based startup Clovyr. “No matter what enterprise platforms look like in 15 years, there will be pieces that evolved from ‘industry coopetition’ conversations that never would have happened otherwise.”

Baldet, who led the team at JPM that built Quorum, said that while there’s “still a long way to go,” enterprises are building more creative systems for decentralized data sharing than ever before.

“The EEA will continue to shape core technologies that move tons of records (and crypto assets) and most consumers will continue to know nothing about any of it – and that is success,” she said.

After the early blockchain hype, which saw almost every decent-sized bank either joining a consortium or announcing a proof-of-concept, the enterprise distributed ledger technology (DLT) space seems to have fallen into what Gartner calls the “trough of disillusionment.” Call it an inevitable phase in the lifecycle of new and potentially transformative technologies.

If you ask the banks and enterprise teams involved in blockchain work what’s happening, most will tell you it’s simply been a case of keeping their heads down and building. Behind the scenes, the EEA has been working hard on standards work, said Yorke E. Rhodes III, a program manager on Microsoft Azure’s blockchain team.

“There has been a tremendous amount of specification work going on,” said Rhodes. “We are building on a foundation of not only five years of Ethereum, but three-plus years with an enterprise focus. It’s a good spot. The things that needed to happen are really happening.”

Freedom of choice

A crucial characteristic of the enterprise Ethereum ecosystem is choice, said Adhara’s Faura.

“It’s very important whatever technology ends up being used is not controlled by a single software vendor, because that creates a huge strategic risk,” Faura said.

The choice of enterprise Ethereum clients widened considerably last year with the release of Hyperledger Besu, a high-profile cross-pollination between the two ecosystems, built by ConsenSys engineers, and designed from the ground up to incorporate the Ethereum mainnet.

ETHEREUM’S COMMUNITY WAS REALLY KEEN TO SEE THIS PLATFORM USED, NOT JUST BY ANARCHISTS AND RADICALS AND PEOPLE WHO WANTED TO TAKE DOWN THE BANKS, BUT BY THE BANKS THEMSELVES.

A hat-tip must go to the then-EEA lead Ron Resnick, who worked tirelessly to broker a deal between Ethereum and Hyperledger, added Faura.

In fact, a bridge between Ethereum and Hyperledger had been a long time coming. Before he became the executive director of Hyperledger, Brian Behlendorf recalls meeting Ethereum chief scientist Vitalik Buterin.

Behlendorf, a leading figure in the open-source software movement, said Ethereum and its growing community reminded him of the culture of the Apache Software Foundation and its friendly approach to corporate use cases.

“I remember being fascinated by the idea of decentralization at the heart of architecture, and something much more interesting than just a cryptocurrency play,” said Behlendorf. “This was a programmatic network for building decentralized applications, and its community was really keen to see this platform used, not just by anarchists and radicals and people who wanted to take down the banks, but by the banks themselves.”

For his part, current EEA Executive Director Daniel C. Burnett said there is a ton of stuff to be excited about, flagging up ConsenSys engineer John Wolpert’s Baseline Protocol as an interesting enterprise project in 2020.

More generally, Burnett pointed to the stability of Ethereum and the end of the frontier mindset of previous years.

“In the past couple of years, things are beginning to settle a bit,” Burnett said. “It’s certainly not boring, but we’re a little less of the Wild West.”