Newest

-

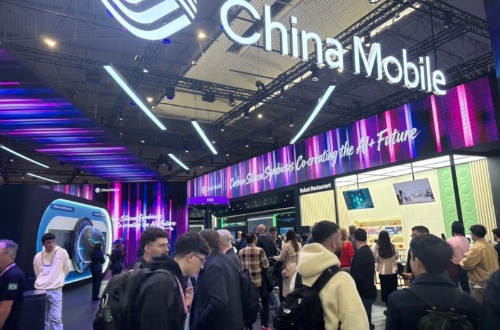

Inside MWC 2026: See How China Mobile Leads the Tech Innovation Wave

-

China Eastern Airlines Announces Comprehensive Upgrade to International Route Network in 2026

-

SOUEAST S08 DM Pre-sale Opens in the UAE:"Motorsuite" Redefines Quality Travel

-

iCAUR Makes Strategic Entry into the Middle East: Announcing V27's Global Launch in UAE

Appier delivers record quarterly revenue and profit with all-time high margins, signals long-term confidence with dividend forecast

Operating profit surged by 2.5 times year-on-year,with EBITDA reaching record highs,highlighting consistent revenue growth and profit

TOKYO,Nov. 14,2024 --

Highlights and achievements of Q3 FY24

Strong growth in key regions led to an all-time high revenue of JPY 9.1 billion with a 28% YoY growth

Profitability reached historical highs,as operating profit increased 2.5 times with an operating margin of 8.7% to a record high

EBITDA improved 79% YoY with an EBITDA margin of 16.9%,and net income expanded 2.7 times with a net margin of 9%

Initiated first forecasted cash dividend payout of JPY 2 per share,underscoring Appier's commitment to sustaining profitable growth with enhanced corporate value

Record-high revenue and margins,with the first forecasted dividend,signal robust performance and sustainable growth

Appier Group Inc (TSE: 4180),henceforth referred to as Appier,today announced its earnings results for the third quarter of fiscal year 2024. Appier achieved record revenue,profitability and operating margins,reaching an all-time quarterly revenue high of JPY 9.1 billion with a robust 28% YoY growth. Operating profit surged 2.5 times,reaching JPY 788 million with an operating margin of 8.7%. Additionally,EBITDA improved by 79% YoY,resulting in a margin of 16.9%.

Net income also significantly increased,expanding 2.7 times to JPY 814 million with a net margin of 9%. Gross profit achieved a quarterly record of JPY 4.9 billion,a 31% YoY increase,with gross margins reaching a historic high of 53.8%. This historic profit expansion has been driven by advancements in AI algorithms and technology enhancements,strong outperformance in NEA and US & EMEA regions,and improved R&D efficiency and sales and marketing productivity,supported by a focused go-to-market strategy and AI insights for larger enterprises.

In a demonstration of confidence in sustained,long-term growth,Appier has initiated its first forecasted cash dividend payout of JPY 2 per share,following the company's first share buyback announced in FY24 Q2 earnings report. This move underscores Appier's commitment to delivering ongoing value to shareholders and highlights the company's dedication to sustaining profitable growth while achieving a well-balanced approach between investments for growth and shareholder returns.

Continued growth fueled by increasing demand across high-growth sectors and regions

Momentum in Q3 was driven by robust growth in Appier's key focus regions,particularly NEA and US & EMEA. NEA's (67%) growth accelerated to 37% YoY this quarter due to solid expansion from existing E-commerce customers and new clients across diverse verticals. Meanwhile,US & EMEA (20%) maintained a robust 20% QoQ growth,driven by rising demand for Digital Content and Other Internet Services.

Incremental revenue contributions remained consistent between existing and new customers,who played a crucial role in sustaining growth through year-end. Existing customers,comprising 55% of incremental revenue,showed strong momentum,particularly in NEA's e-commerce and Digital Content verticals in US & EMEA. New customers,representing 45% of incremental revenue,benefited from continuous vertical diversification,with notable growth in the Digital Content verticals in NEA and US & EMEA and China outbound activities.

Laying the foundation for sustainable growth and long-term vision through continuous investment in advanced AI capabilities

Appier's growth has been propelled by relentless enhancements in AI algorithms,enabling highly precise targeting that consistently maximizes returns on investment and elevates customer success. With a strategic focus on larger enterprises,Appier's customer base grew to 1,815,reflecting a 16% YoY increase while maintaining a historically low churn rate of 0.47%.

"Our advancements in AI and continuous algorithm enhancements are setting the stage for a new era of operational efficiency and transformative impact for our customers," said Dr. Chih-Han Yu,CEO and Co-Founder of Appier. "With key milestones in AI research,strategic partnerships,and operational excellence,we are building momentum toward a future where AI fuels sustainable growth and innovation across industries. The forecasted cash dividend reflects our long-term vision and confidence in creating lasting value for shareholders,and our vision of enduring success in AI leadership."

Deepen AI impact via GenAI,copilot mode and cross-product synergies

Appier continues to deepen its unique positioning within the AI stack's application layer,focusing on a results-driven product development strategy. Through fundamental GenAI and Large Language Model (LLM) research,Appier delivers scalable,contextually relevant solutions across industries by enhancing model accuracy and reliability,reinforcing its commitment to long-term growth and leadership in AI-driven business solutions that provide extra ROI for its customers.

About Appier

Appier (TSE: 4180) is a software-as-a-service (SaaS) company that uses artificial intelligence to power business decision-making. Founded in 2012 with a vision of democratizing AI,Appier's mission is turning AI into ROI by making software intelligent. Appier has 17 offices across APAC,Europe and US and is listed on the Tokyo Stock Exchange. Visit www.appier.com for more company information,and visitir.appier.com/en/ for more IR information.

2024-11-15

2024-11-15